Eligibility Criteria Accounting for Startups and SMEs

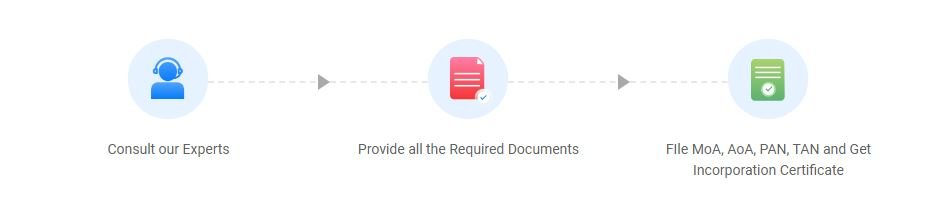

Business Registration:

- The startup or SME should be a legally registered business, such as a sole proprietorship, partnership, limited liability partnership (LLP), or private limited company under Indian regulations.

Annual Turnover:

- Typically, businesses with a turnover below a specific threshold (often ₹5 crore for SMEs) qualify for simplified accounting methods under various government schemes. However, businesses exceeding this threshold may need to adhere to more complex accounting standards and audits.

GST Registration (if applicable):

- If the business’s turnover exceeds the GST threshold limit (₹40 lakhs for most businesses), it must be GST-registered, and the accounting system should be compliant with GST regulations, including tracking input/output taxes.

Nature of Business:

- The type of business (manufacturing, service, retail, etc.) influences the accounting requirements. For example, manufacturing businesses will need to track inventory and cost of goods sold, while service-based businesses might focus on revenue and expense management.

Auditing Requirements:

- Startups or SMEs with annual turnover exceeding ₹1 crore (for a business other than a professional firm) may require an audit as per Indian tax laws, and should adhere to audit standards under the Income Tax Act and the Companies Act, 2013.

Tax Compliance:

- The business should be compliant with tax filing requirements, including income tax returns, GST returns, and other necessary filings, depending on its structure and turnover.

Financial Record-Keeping:

- Businesses must maintain accurate financial records, including balance sheets, profit and loss statements, cash flow statements, and supporting documents like receipts, invoices, and bank statements.