Edit Content

We are the Best

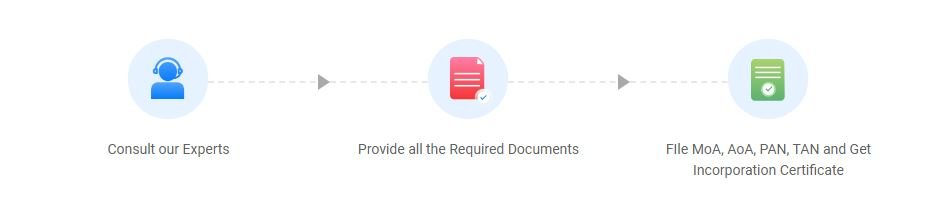

Get free Consultant With out Experts.

Other Services

Fundraising

- Fundraising

- Pitch Deck

- Business loan

- DPR Service

NGO

- NGO

- Section 8 Company

- Trust Registration

- Society Registration

Property & Personal

- Property Title Verification

- Property Registration

- Rera Complaint

Lawyers & Experts

- Labour Law Advisor

- Criminal Lawyer

- Labour Lawyer

- Consumer

- Court Lawyer

- Divorce Lawyer

- Banking Lawyer

- Immigration Lawyer

- Family Lawyer

- Litigation Lawyer

- Intellectual Property Lawyer

- Trademark Lawyer

Notice: File your Company Audit before the 30th September deadline. Talk to our expert