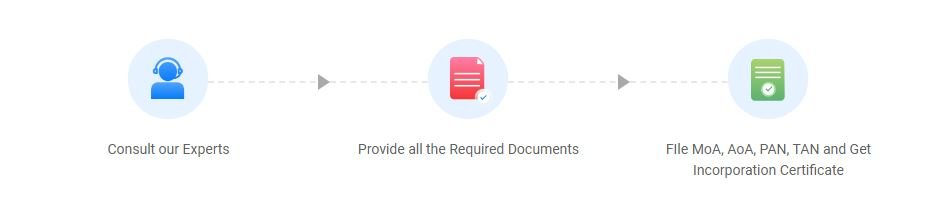

A Sole Proprietorship is the simplest form of business in India, where one person owns and manages the entire business. It does not require complex incorporation or registration under company laws, which makes it quick and cost-effective to start. The proprietor enjoys full control and keeps all the profits, but also bears complete responsibility for any business liabilities. This structure is best suited for small traders, shopkeepers, freelancers, and service providers who want to start their business with minimum compliance and paperwork.

Edit Content

We are the Best

Get free Consultant With out Experts.

Other Services

Fundraising

- Fundraising

- Pitch Deck

- Business loan

- DPR Service

NGO

- NGO

- Section 8 Company

- Trust Registration

- Society Registration

Property & Personal

- Property Title Verification

- Property Registration

- Rera Complaint

Lawyers & Experts

- Labour Law Advisor

- Criminal Lawyer

- Labour Lawyer

- Consumer

- Court Lawyer

- Divorce Lawyer

- Banking Lawyer

- Immigration Lawyer

- Family Lawyer

- Litigation Lawyer

- Intellectual Property Lawyer

- Trademark Lawyer

Notice: File your Company Audit before the 30th September deadline. Talk to our expert